Analysis of Needle Coke Import and Export Data in 2022

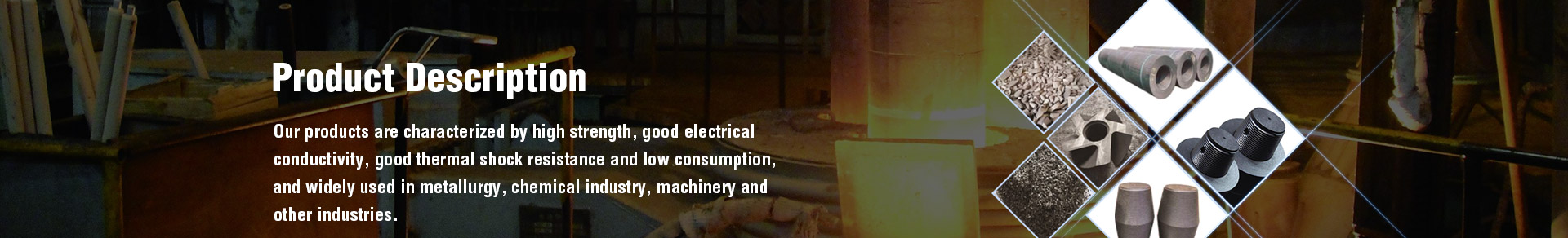

From January to December 2022, the total import of needle coke was 186,000 tons, a year-on-year decrease of 16.89%. The total export volume totaled 54,200 tons, a year-on-year increase of 146%. The import of needle coke did not fluctuate much, but the export performance was outstanding.

In December, my country's needle coke imports totaled 17,500 tons, an increase of 12.9% month-on-month, of which coal-based needle coke imports were 10,700 tons, an increase of 3.88% month-on-month. The import volume of oil-based needle coke was 6,800 tons, an increase of 30.77% from the previous month. Looking at the month of the year, the import volume is the least in February, with a monthly import volume of 7,000 tons, accounting for 5.97% of the import volume in 2022; mainly due to the weak domestic demand in February, coupled with the release of new enterprises, the domestic supply of needle coke The volume increased and some imports were restrained. The import volume was the highest in May, with a monthly import volume of 2.89 tons, accounting for 24.66% of the total import volume in 2022; mainly due to the significant increase in the demand for downstream graphite electrodes in May, the increased demand for cooked coke imports, and the domestic needle-shaped The price of coke is pushed to a high level, and imported resources are added. On the whole, the import volume in the second half of the year decreased compared with the first half of the year, which is closely related to the sluggish downstream demand in the second half of the year.

From the perspective of import source countries, needle coke imports mainly come from the United Kingdom, South Korea, Japan and the United States, of which the United Kingdom is the most important import source country, with an import volume of 75,500 tons in 2022, mainly oil-based needle coke imports; followed by South Korea The import volume was 52,900 tons, and the third place was Japan's import volume of 41,900 tons. Japan and South Korea mainly imported coal-based needle coke.

It is worth noting that in the two months from November to December, the import pattern of needle coke has changed. The United Kingdom is no longer the country with the largest import volume of needle coke, but the import volume from Japan and South Korea has surpassed it. The main reason is that downstream operators control costs and tend to purchase low-priced needle coke products.

In December, the export volume of needle coke was 1,500 tons, down 53% from the previous month. In 2022, China's needle coke export volume will total 54,200 tons, a year-on-year increase of 146%. The export of needle coke hit a five-year high, mainly due to the increase in domestic production and more resources for export. Looking at the whole year by month, December is the lowest point of export volume, mainly due to the greater downward pressure of foreign economies, the downturn in the steel industry, and the decline in demand for needle coke. In August, the highest monthly export volume of needle coke was 10,900 tons, mainly due to the sluggish domestic demand, while there was export demand abroad, mainly exported to Russia.

It is expected that in 2023, domestic needle coke production will further increase, which will curb part of the demand for needle coke imports, and the needle coke import volume will not fluctuate much, and will remain at the level of 150,000-200,000 tons. The export volume of needle coke is expected to continue to increase this year, and is expected to be at the level of 60,000-70,000 tons.

Previous: None

Previous: None